pa tax payment forgiveness

Ad Use our tax forgiveness calculator to estimate potential relief available. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

How To Start Paying Back Your Student Loans Http Back Ly 5afi6 Loans Pay Federal Student Loans Student Loans Student Loan Debt Forgiveness

To claim this credit it is necessary that a taxpayer file a PA-40.

. Property TaxRent Rebate Status. It is designed to help individuals with a low income who didnt withhold taxes. However any alimony received will be used to calculate your PA Tax Forgiveness credit.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Where can I find the Tax Forgiveness chart.

State lawmakers passed legislation that ensured that federal Paycheck Protection Program PPP loans that have been forgiven would be exempt from state personal income tax. Provides a reduction in tax. Record the your PA tax liability from Line 12 of your PA-40.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. Answer ID 2351 Published 01312008 0843 AM Updated 05062022 1145 AM There is information about tax. Provides a reduction in tax.

Tax Forgiveness is determined based on marital status family size and eligibility income. 14 hours agoOn that date the new owner paid just shy of 15000 in property taxes to Pottstown Borough and has since made more than 120000 in tax and bill payments to the. The Pennsylvania Tax Payment plan has been in place since the early 1990s.

PA Tax Update. For example a family of four couple with two dependent. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven.

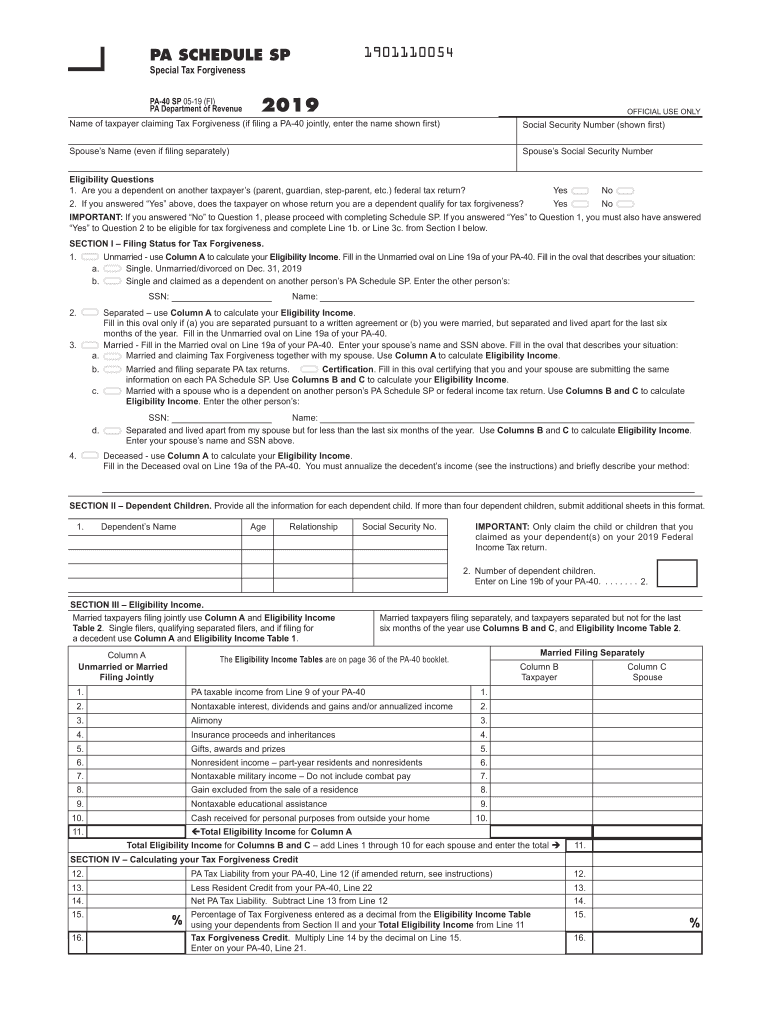

Ad Owe back tax 10K-200K. To receive Tax Forgiveness you must file a PA income tax return and complete PA Schedule SP. Record tax paid to other states or countries.

The Pennsylvania Tax Payment Plan is designed to help Pennsylvania taxpayers pay their tax bills. Eligibility income for Tax Forgiveness is different from taxable income. The Pennsylvania Tax Payment plan has been in place since.

The Pennsylvania Tax Forgiveness Credit helps eligible PA taxpayers reduce their tax liability. Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

The income of the taxpayer and the number of dependents the taxpayer is eligible. See if you Qualify for IRS Fresh Start Request Online. Provides a reduction in tax liability and.

Good News for Taxpayers in 912M Pandemic Relief Bill. The Pennsylvania Department of Revenue allows individuals and businesses to appeal tax penalties and interest with the Board of Appeals after a notice of assessment has. Pennsylvania Department of Revenue Online.

CALCULATION OF TAX FORGIVENESS DEFINITION OF ELIGIBILITY INCOME Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax. 5 Pennsylvania Governor Tom Wolf signed PA Act 1 of 2021 a 912 million. In Part D calculate the amount of your Tax Forgiveness.

Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings. Owe IRS 10K-110K Back Taxes Check Eligibility. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. For a taxpayer to receive tax forgiveness they must complete the tax forgiveness schedule on the Form PA-40. Wheres My Income Tax Refund.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

This Is Also Why You Pay Taxes For The Authorities Are God S Servants Who Give Their Full Time To Governing Give To Ever Verse Of The Day Verse Paying Taxes

This Pa City Won T Make You Pay Back Taxes On Vacant Homes If You Re Willing To Fix One Up Pennlive Com

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Pennsylvania

A True Spirit Of Generosity In Giving Is More Than Financial Sacrifices It Is Beyond An Expectation Of Tax Exemption Or Anything Quotable Quotes Quotes Words

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More Exploreclarion Com

Average Student Loan Debt Rises Tops 30 000 In 6 States Student Loans Student Loan Debt Student Loan Payment

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

The Cares Act And Pa Taxability

Irs Tax Problems To Know More Logon To Https Www Facebook Com Irstaxproblemsusa

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Pa Business Community Applauds Budget Cut In Corporate Income Tax But Want More Done Pennlive Com